“So what you need to know is that the Texas miracle is a myth, and more broadly that Texan experience offers no useful lessons on how to restore national full employment. It’s true that Texas entered recession a bit later than the rest of America, mainly because the state’s still energy-heavy economy was buoyed by high oil prices.” — Paul Krugman, New York Times, August 14, 2011. Oil price: $87 per barrel

Recent oil price peak on June 20, 2014: $108 per barrel

“But everything is bigger in Texas, including inflated expectations, so the slowdown has come as something of a shock. Now, there’s no mystery about what is happening: It’s all about the hydrocarbons.” — Paul Krugman, New York Times, June 5, 2015. Oil price: $60 per barrel

Oil price on May 25, 2016: $50 per barrel

The Texas miracle has included robust economic growth and job creation during at least the last decade. Liberal economist Paul Krugman and others have argued the Texas miracle would end after the steep drop in oil prices. However, the still-growing Texas economy shows us they were wrong. Since the Texas economy didn’t fall off a cliff, other states and DC can learn a lot from Texas’ free-market governing approach.

Krugman wrote last year, and has repeatedly made this case about Texas, that “there’s no mystery about what is happening: It’s all about the hydrocarbons.” So what about oil?

Krugman’s argument is that the Texas miracle was only about oil prices and not the Texas model of low taxes overall, no personal income tax, relatively restrained government spending, and predictable regulations. Again, given that oil prices remain less than half of what they were at their peak, Krugman and all those arguing that the Texas model will fail are just wrong.

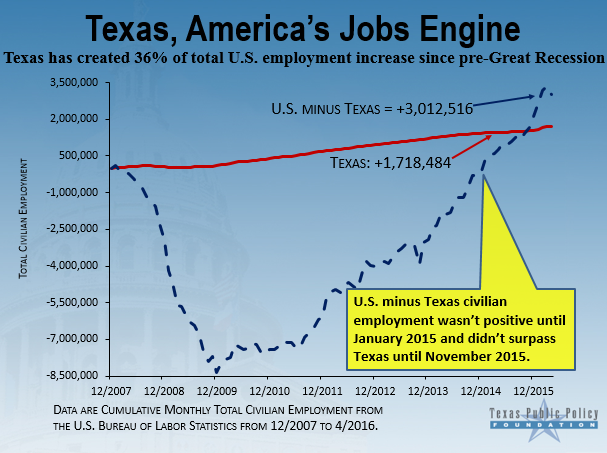

Texas: A Jobs Powerhouse

First, let’s identify the Texas miracle. Since the last national recession started in December 2007, Texas has created 36 percent of all civilian jobs added nationwide in a state with less than 10 percent of the country’s population. Employment in the rest of the United States didn’t turn positive until January 2015 and didn’t surpass Texas’ job creation until November 2015.

The best way out of poverty is a job, so this miraculous job creation has been a boon for Texas families and families that have arrived from other states.

Sure, economic growth and job creation in Texas have slowed compared with growth rates before the oil price crash. Economic growth in the second and third quarters of 2015 was less than 1 percent, and the annual nonfarm job creation rate is less than half of what it was at the recent peak of oil prices. Although places more dependent on oil and gas activity have slowed substantially, Houston’s unemployment rate remains relatively low at 4.9 percent and Midland’s even lower at 4.3 percent.

But the drop in oil prices was not an isolated economic event that contributed to slower growth in Texas. Other challenges since 2014 include a slower global economy and a stronger U.S. dollar. Really, the oil market is dependent on these global factors, so by definition the oil price can’t be the sole cause of slower growth.

Free-Market Economies Are Resilient

Moreover, things are much different in Texas than they were back in the 1980s. This is what Krugman and others really get wrong about the Texas miracle.

The state had its last major recession from 1986 to 1987, after oil prices collapsed and the real estate and financial sectors crashed. Back then, the mining sector, dominated by oil and gas activity, was directly related to about 21 percent of the real private economy and roughly 5 percent of the labor force. Today, mining is 15 percent of the real private economy and less than half of the labor force share. As a result, the combination of more economic diversification and pro-growth policies has produced a much more resilient economy. Texas in 2016 looks a lot different than Texas in 1987.

Economic diversification also means Texas is more dependent on the rest of the U.S. and international trade. The current U.S. economic expansion of only 2.1 percent average annual growth is set to be the weakest recovery since World War II, with no relief in sight. With the Federal Reserve having held interest rates too low for too long and rightly beginning to tighten credit last December, slower economic growth and lower oil prices are likely to continue as highly distorted markets correct.

Suffocating regulations by the Obama administration, including Dodd-Frank and ObamaCare, also factor into the equation. Overregulation has pushed the American dream further out of reach for too many Americans. Without growth in exports and the oil and gas sector, which fueled much of the U.S. economic expansion since 2009, the national economy stands on a shaky foundation that may have a costlier effect on Texas than low oil prices.

Behold the Strength of the Texan Economy

But no matter what’s slowing Texas’ economy, the sky isn’t falling, as critics love to argue when grasping for an economic narrative that repudiates free markets and fiscal conservatism. Such a narrative can’t withstand scrutiny. The latest state-level jobs report by the Bureau of Labor Statistics shows that Texas added to its payrolls in a remarkable 65 of the last 67 months. This job creation has led to an unemployment rate of 4.4 percent that’s been at or below the national average for 112 straight months.

States that are not as well diversified haven’t fared as well. During the last 12 months, nonfarm job creation declined by 17,600 (-3.8 percent) in North Dakota, 10,800 (-3.7 percent) in Wyoming, 3,500 (-1 percent) in Alaska, 12,300 (-0.6 percent) in Louisiana, and 2,100 (-0.1 percent) in Oklahoma. Texas, on the other hand, created a positive 189,600 jobs (1.6 percent) with 154,200 new private-sector jobs in all but the mining and manufacturing sectors, which were hardest hit by the economic headwinds.

These haven’t all been low-wage jobs, either. The Federal Reserve Bank of Dallas finds that job creation in Texas from 2005 to 2014 has increased by about 25 percent in both the upper-middle and highest income quartiles while the lowest income quartile has increased by slightly more than 30 percent. Job creation in the rest of the United States has increased by less than 5 percent in the upper two quartiles and by 25 percent in the lowest quartile.

Clearly, Texas has been the place where both high- and low-wage jobs have been created, which is necessary to meet the skills of a diversified workforce so everyone has an opportunity to succeed.

Texas faces real, and potentially major, economic challenges. However, state lawmakers could strengthen the Texas model’s proven recipe of a diversified economy and limited government philosophy. The sooner other states adopt and adapt that model, the better they will be able to meet economic challenges and propel America towards greater prosperity. By continuing to reduce the size and scope of government, families will prosper and refute the false claims by Krugman and others. The truth is, it’s not all about oil in Texas.