“In conservative media, ObamaCare is a disaster. In the real world, it’s working.”

So claims the usually over-confident liberal editorialist Ezra Klein on his website, Vox.com. Klein says Obamacare is working because premiums on its exchanges are “lower than expected” and that the number of companies offering plans on the exchanges “in 2015 will increase by 25 percent.” But, Klein complains, most conservatives probably don’t know this, since right-leaning websites “run multiple articles every day on the problems and nothing on the broader trends.”

“The law is working,” Klein concludes, “but a lot of the people who are convinced ObamaCare is a disaster will never know that, because the voices they trust will never tell them.”

Despite what Klein suggests, Obamacare is becoming an even bigger mess. Here’s a round-up of the problems Obamacare has caused as the exchanges head into the second open-enrollment season November 15.

1. Premium Increases

Although President Obama promised that a family of four would save $2,500 in premium costs thanks to Obamacare, almost the exact opposite has proven true. The Kaiser Family Foundation shows that the average employer-based family policy that cost $13,770 in 2010 cost $16,834 in 2014, an increase of more than $3,000.

2. Exchange Subsidy Roller Coaster

While the Left hailed the new insurance companies entering the exchanges and the lower premium costs that would result, they forgot to mention that exchange subsidies could also decline. Since 83 percent of exchange consumers have subsidies, a lot of people could be in for hefty premium increases as their subsidies begin to decrease.

The subsidy amount is determined by a formula based on the second lowest-cost silver plan on an exchange minus the amount of money an individual is required by law to put toward the insurance premiums, known as the “applicable percentage.” Let’s say that the second lowest-cost silver plan last year was $200 per month while an enrollee’s applicable percentage was $150 per month. The enrollee’s subsidy was $200 – $150 = $50 per month. This year, however, if a new company enters the exchange offering lower-cost insurance, and the second lowest-cost silver plan becomes $175 per month, the enrollee’s subsidy is now $175 – $150 = $25 a month. If the enrollee keeps the same plan (Obamacare automatically re-enrolls individuals in the plans they had in 2014), he would pay $300 more per year for it.

This is far from hypothetical. A preliminary analysis by the state of Colorado found that the new lower-cost silver plans could cause exchange consumers to see their premiums rise by an average of 77 percent next year if they keep their current plans.

3. Reducing the Quality of Insurance

The regulations governing Obamacare exchanges have reduced the quality of insurance plans. To cover the cost of the regulations and keep premiums even remotely reasonable, insurers had to increase people’s out-of-pocket costs and reduce provider networks. A National Center for Public Policy Research study found an average of 33 policies for a 27-year-old on the individual market in 2013 had both lower premiums and lower or equal out-of-pocket costs than the cheapest policy on the exchange. There were ten such policies for a 57-year-old couple. A Health Pocket study found that deductibles were, on average, 42 percent higher than plans that were on the individual market in 2013.

The pejorative term “skinny network” came to describe the networks of physician hospitals and other providers available through exchange plans, and for good reason. An Associated Press survey found that only four of the top 19 cancer centers in the country said they “have access through each of the insurance companies in the state exchanges.” Dr. Scott Gottlieb of the American Enterprise Institute examined exchange policies in nine states and found that access to specialists was up to 65 percent lower than in comparable preferred provider organization (PPO) plans. A recent Avalere study found that, on average, only 32 percent of the top ten cardiologists, neurologists, and diagnostic radiologists in ten major cities were available through the three cheapest silver plans on the exchanges. The National Center study found that the average number of PPO plans on the exchange declined when compared to the individual market while the number of plans with more restrictive health maintenance organizations (HMO) increased considerably.

In short, people who lost their plans in 2013 and had to go on the exchanges were extremely likely to face both higher out-of-pocket costs and a harder time finding heath care providers who would take their insurance.

4. Slashing Quality of Employer-Provided Insurance

The network side of Obamacare doesn’t appear likely to improve anytime soon. In California, insurers on the exchange plan to keep the skinny provider networks despite substantial consumer criticism. A Los Angeles Times analysis of company data shows that some networks will continue to shrink. Insurer HealthNet, the Times says, is dumping one of its Preferred Provider Network plans and “switching to a plan with 54 percent fewer doctors and no out-of-network coverage, state data show.” Adding insult to injury, the premiums are increasing 9 percent. The Times reports the company said “its cutbacks were necessary to avoid even steeper rate hikes.”

Obamacare’s impact on quality is beginning to be felt in the employer-based market, too. Surveys by the New York and Philadelphia Federal Reserve Banks found more businesses were reducing the size of their networks and the range of services covered than were increasing them. They also found the percentage of businesses that are increasing employee contributions, premiums, deductibles, out-of-pocket maximums, and co-pays far exceeds the percentage of those that are reducing them.

5. Here Come the Trial Lawyers!

It was probably only a matter of time before skinny networks brought out the sharks. A class-action lawsuit has been filed against Anthem Blue Cross in California accusing the insurer of “misleading ‘millions of enrollees’ about whether their doctors and hospitals participate in its new reform plans.” This lawsuit is probably the first of many.

6. Enrollees Are Older and Sicker than Average

The insurance risk pools on the Obamacare exchanges need a substantial number of young and healthy people to keep premiums from skyrocketing over the long run. Only 28 percent of exchange enrollees are between the ages 18-34, far short of the 38 to 40 percent the Obama administration said would be needed.

What those who read only liberal websites probably won’t know is that exchange enrollees tend to be sicker, too. For example, a good indicator of a person’s health is his or her self-reported health status. A Gallup poll found that newly-insured people who obtained policies on the exchanges reported that they were less healthy, on average. About 37 percent said they were in excellent or very good health, while 22 percent said they were in fair or poor health. Among the entire adult population, the corresponding numbers are 50 percent and 18 percent, respectively.

There are other hints that the exchange population may not be healthy enough to keep the insurance pools stable. In May, North Carolina Blue Cross Blue Shield officials complained in a press release that not as many young and healthy applicants had signed up for their exchange products as the company wanted. Worse, the release stated, “Early self-reported data indicates that BCBSNC’s young [Obamacare] customers (ages 18-34) are less healthy and seeking more medical treatment than we typically see in this age group.”

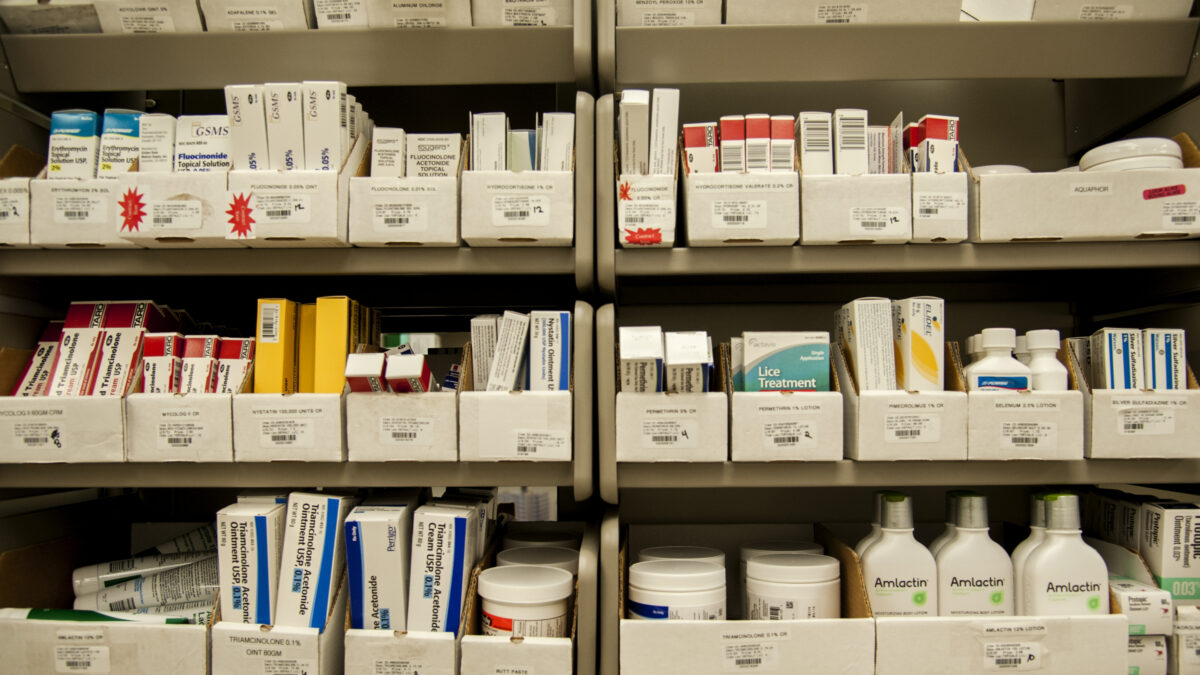

Finally, research from Express Scripts shows that about 1.3 percent of prescriptions filled for exchange enrollees were specialty drugs. The comparable number in other private plans is about 0.8 percent. That may not seem like a big difference, but specialty drugs are usually quite expensive. As the Express Scripts’ study notes, “despite comprising less than 1% of all U.S. prescriptions, specialty medications now account for more than 25% of total pharmacy” spending.

7. People Dropping Exchange Coverage Are the Ones Exchanges Need Most

What will make the risk pools even worse is that the people dropping out of the exchanges are likely younger. Thus far, at least 700,000 people have been dropped from the exchanges for not paying their premiums. While we don’t have any demographic data on them yet, a survey from April found that those aged 18-29 were twice as likely to have failed to pay their first premium compared to people over age 30. Given that people under age 30 also have lower credit scores—i.e., they are less likely to make payments on time, if at all—it’s a good bet that a disproportionate share of the people who have dropped out of the exchanges are “young invincibles.”

8. The Exchanges Benefit Big Business at the Expense of Smaller Businesses

A recent Government Accountability Office (GAO) report found that consumers had access to an average of 36 insurers in their states in 2012. That dropped to an average of three on the Obamacare exchanges. Large insurers were the most likely to participate on the exchanges, while “most smaller issuers with less than 5 percent of the 2012 market did not participate in the 2014 exchanges,” according to the GAO report. It’s not clear why the small companies didn’t participate, but Sen. Tom Coburn (R-OK) identified perhaps the likeliest reason when he said, “the GAO report provides evidence that the health care law’s burdensome requirements may be giving an unfair advantage to big insurers over smaller ones.”

9. Policy Cancellation Déjà Vu

Insurance cancellations are the gift no one wants but Obamacare keeps on giving. Last year, roughly 6 million policyholders lost their insurance in the individual market because it did not meet Obamacare requirements. This year, about 350,000 additional policyholders have lost their plans. That accounts for policyholders in only eight states, so more policy cancellations are probably to come.

10. Medical Research Has Tanked

Investment in the medical device industry tanked in 2012 after the medical device tax took effect. It has only recently begun to recover. Medical device makers such as Medtronic, Boston Scientific, Stryker, Abbott Laboratories, Johnson & Johnson, and Smith & Nephew all announced layoffs during the last two years. Perhaps that’s why revenues from the medical device tax have come in under estimates. The tax was supposed to yield about $1.2 billion in revenue in the first six months of 2013, according to the Internal Revenue Service. A report from the Treasury inspector general for tax administration, however, found that it had taken in about $913 million.

11. Medicaid Still Provides Terrible Care for the Poor

Since October of last year, 8.7 million people have signed up for Medicaid, although at least one million of them would have qualified for Medicaid even without the Obamacare expansion. The Medicaid expansion, however, doesn’t seem to have improved access to health care.

Thus far, the new Medicaid beneficiaries are going to the same place for health care Medicaid beneficiaries have always gone: the emergency room. A Colorado Hospital Association study found that emergency room (ER) visits increased 5.6 percent in Medicaid expansion states from the second quarter of 2013 to the second quarter of this year. By contrast, hospitals in non-expansion states saw ER visits increase by less than 2 percent. During that same period, Medicaid charges also increased 26 percent at hospitals in expansion states but rose less than 4 percent in non-expansion states.

Research shows that Medicaid beneficiaries have more trouble getting appointments with primary care physicians, specialists, and ambulatory clinics than patients with private insurance, likely due to Medicaid low reimbursement rates. That’s also a big reason they end up seeking care in ERs. The logic behind the Medicaid expansion appears to have been “let’s try more of the same and see if we get different results.” So far, it hasn’t worked.

12. The Deficit Will Increase $131 Billion in the Next Ten Years

For years, liberals have clung to Congressional Budget Office (CBO) estimates that Obamacare will reduce the deficit. Yet Republicans on the Senate Budget Committee recently updated the CBO’s number and found that Obamacare now increases the deficit by $131 billion over the next ten years. The biggest change is a drop in revenue due to Obamacare’s effect on employment. In February, a CBO analysis found that, by 2024, Obamacare would reduce the number of hours employees work by an equivalent of 2.5 million jobs. Fewer hours worked, of course, means fewer taxes paid.

13. Fewer Jobs for Low-Wage Workers

Obamacare’s employer mandate requires employers with 50 or more full-time employees—“full time” defined as 30 hours or more per week—to provide their workers with health insurance or pay a fine. Critics claimed this would lead to an increase in part-time work leading up to the mandate’s imposition, but many liberal economists insisted part-time work was not increasing. Then Jed Graham of Investor’s Business Daily dug into the data and found that work hours had declined for employees in industries where the average hourly wage was $14.50 or less.

Graham showed that part-time work appeared stable because the decline in hours for low-wage workers was offset by an increase in hours for higher-paid workers. As Graham states, “Overall, in these low-wage industries which employ 30 million rank-and-file workers, the average workweek shrank to 27.3 hours per week in July [2014]…. For low-wage industry workers… the recovery in the workweek from a then-record low 27.5 hours in mid-2009 began to reverse in the latter half of 2012, and it’s been pretty much all downhill since then.” Employers appear to be limiting the work hours of employees who are least likely to have employer-provided insurance. Given the low wages, there are likely many workers in this group who are in need of full-time hours.

14. More Economic Woes Ahead

The employer mandate is causing even more damage as its January 1, 2015 imposition nears. In August, the Federal Reserve Banks of Dallas, New York, and Philadelphia released survey data on how businesses in their regions were responding to the costs of Obamacare. Businesses that had or were expecting to increase part-time employees, outsourcing, and prices far exceeded the number that that had or intended to reduce them. More business also had or intended to reduce the total number of workers and/or wages in response to Obamacare than expected to increase them.

Interestingly, with the exception of skinny networks and the Medicaid problems, none of what appears above is mentioned on Vox. Amusingly, Vox did mention that premiums for silver plans are dropping, but only noted “it’s good for the federal budget” because the government would be spending less on subsidies. Apparently, a person can get the most biased view of Obamacare if he pays attention only to liberal websites such as Vox.

Klein wrote, “It’s easy to give people a skewed impression of ObamaCare without ever running a false story.”

Indeed, it is.